Enquires@newsofbitcoin.com

In the current digital landscape, embracing cryptocurrency as a payment method can offer fresh opportunities for businesses. However, it’s crucial to grasp the fundamentals of cryptocurrency acceptance beforehand. Cryptocurrency, a digital or virtual currency secured by cryptography, functions on decentralized blockchain networks. Incorporating cryptocurrency into your business entails integrating payment gateways or platforms that enable transactions with digital currencies. Understanding these principles is vital for businesses looking to tap into the growing trend of fiat to crypto payments.

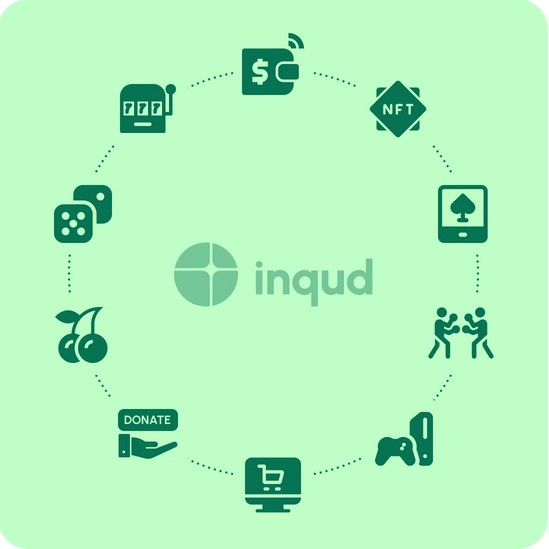

In recent years, there has been a rapid growth in interest in cryptocurrencies as an alternative payment method, which is reflected in their implementation by major companies worldwide. For example, giants like Microsoft, PayPal, Tesla, and Overstock have already integrated cryptocurrency payments into their systems. This trend is not limited to large corporations, as many small and medium-sized enterprises are also considering the possibility of accepting cryptocurrencies. It is suitable for a wide range of businesses, but particularly valuable for crypto projects, e-commerce, high-risk ventures, information technology, and financial technology.

Steps to Accept Cryptocurrency

1. Educate Yourself and Your Team:

Before diving into the world of cryptocurrency, take the time to educate yourself and your team about how it works. Familiarize yourselves with different types of cryptocurrencies, blockchain technology, and the process of crypto transactions. Investing in training sessions or online courses can provide valuable insights into the intricacies of cryptocurrency acceptance.

2. Choose a Reliable Payment Processor:

Selecting the right payment processor is crucial for smooth cryptocurrency transactions. Look for reputable payment gateways or platforms that support a wide range of cryptocurrencies and offer robust security features. Evaluate factors such as transaction fees, ease of integration, and customer support before making a decision.

3. Integrate Cryptocurrency Payment Options:

Once you’ve chosen a payment processor, integrate cryptocurrency payment options into your existing checkout process. Ensure that your website or point-of-sale system is compatible with the chosen payment gateway. Display clear instructions and information about cryptocurrency payments to guide customers through the process. Additionally, consider offering incentives such as discounts or rewards for customers who choose to pay with cryptocurrency to encourage adoption.

Accepting cryptocurrency offers several benefits for businesses. Firstly, it expands the customer base by attracting tech-savvy individuals who prefer using digital currencies. Secondly, it eliminates geographical barriers and enables international transactions without the need for currency conversion. Additionally, cryptocurrency transactions are secure, transparent, and irreversible, reducing the risk of fraud and chargebacks commonly associated with traditional payment methods.

Choosing the right crypto payment gateway is an important decision for businesses looking to accept digital currency payments. This gateway acts as a link between customers, merchants, and the blockchain network, facilitating safe and efficient cryptocurrency transactions. When choosing a payment gateway, there are several factors to keep in mind.

Firstly, assess the range of cryptocurrencies supported by the gateway. Make sure it supports the cryptocurrencies that align with your business goals and customer preferences. Also, consider the transaction fees involved. Look for clear fee structures and competitive rates to keep costs low. Security is also crucial. Choose a payment gateway with strong security measures like encryption and two-factor authentication to protect transaction data and prevent fraud.

The implementation of cryptocurrency payments can be done through API integration with payment systems or by adding a cryptocurrency widget to the company’s website.

In today’s business landscape, APIs are fueling innovation, revolutionizing payment services. The projected growth of the API management market, expected to reach US$46.74 billion by 2030, emphasizes their significance. The Inqud API showcases this potential through its swift integration process, transparent documentation, and personalized support. With diverse payment options, scalability, and cost-efficiency, APIs are highly appealing. They’re reshaping industries by enhancing user experiences and optimizing operations, cementing their role as a pivotal innovation in the payments sector.

Read More: Unlocking New Horizons: How to accept crypto as a business

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.