Enquires@newsofbitcoin.com

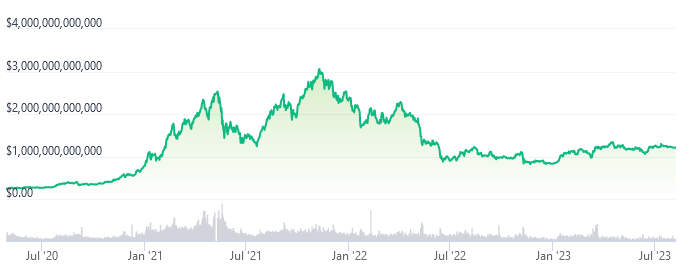

In recent months, there has been a barrage of cryptocurrency news owing to market turbulence and piecemeal regulatory developments. The cryptocurrency market—a $1.7 trillion industry that has grown substantially in the last decade—still suffers significant volatility. Moreover, cryptocurrencies fall into several regulatory gaps as federal regulatory oversight of the market is severely underdeveloped.

Crypto Tracker charts policy developments in cryptocurrencies, stablecoins, central bank digital currencies, and other digital assets from federal, state, and international regulators.

Market Value

Source: CoinGecko

Tracker

1/10/2024 – The SEC paves the way for bitcoin ETFs, opening the market to ordinary investors.

11/21/2023 – Cryptocurrency exchange Binance agrees to pay $4.4bn to settle charges brought by federal agencies after prosecutors claimed that the company aided terrorist networks including Hamas and violated sanctions.

8/29/2023 – A federal court rules in favor of Grayscale Investments in the second significant court loss for the SEC in two months – the court ruling should make it easier to create a cryptocurrency ETF.

8/28/2023 – House Financial Services Chair Patrick McHenry authors a letter to the Federal Reserve questioning its role in overseeing stablecoins.

8/28/2023 – The SEC charges a media company with its first ever NFT enforcement action.

8/25/2023 – The Treasury Department releases proposed regulations governing crypto tax reporting requirements but notes that implementation will not occur until 2025.

8/8/2023 – In the continued absence of Congressional movement on stablecoins, the Fed released further guidance for banks; the expectations set by the Fed were low and notably did not apply to non-bank financial services stablecoin issuers.

8/7/2023 – Payments titan PayPal announces the launch of its own stablecoin, by far the largest financial services firm to do so. Notably, PayPal will not itself issue the stablecoin, leaving that to crypto partner Paxos.

7/31/2023 – A federal judge rejected the legal basis for the Ripple case, refuting the findings and placing the precedent in doubt.

7/26/2023 – The House Financial Services Committee, followed the next day by the House Agriculture Committee, approved holistic crypto legislation giving specific powers to the SEC. A companion bill on stablecoins was shelved.

7/13/2023 – A federal judge ruled that Ripple Lab’s cryptocurrency, XRP, represents a security when sold to institutional investors but not in other cases. This ruling represents a challenge not just to the SEC’s authority but also adds a new wrinkle to the securities vs. commodity debate.

6/9/2023 – A federal judge orders online investment platform Ooki DAO to cease operations, marking the first time a decentralised autonomous organization (DAO) has been found liable for operating an illegal trading platform.

6/6/2023 – The SEC launches a major new offensive against crypto with a series of lawsuits targeting Binance and Coinbase.

6/2/2023 – House Republicans from the Financial Services and Agriculture Committees unveil the proposed text for a new crypto regulatory regime. Under the proposed text significant power would move from the SEC to the CFTC, as it would allow crypto companies an “off ramp” to apply for more lenient CFTC scrutiny.

5/23/2023 – FINRA approve Prometheum Ember Capital’s bid to custody crypto securities, making it the first SEC registered broker-dealer to be able to do so.

4/24/2023 – Cryptocurrency exchange Coinbase sues the SEC in an attempt to get the agency to commit to the creation of a suite of rules for the digital asset market.

4/19/2023 – The House Financial Services Committee subcommittee on digital assets holds a hearing on stablecoins and the need for stablecoin legislation. In advance of the hearing the Committee re-publishes draft stablecoin legislation from 2022 unchanged despite criticism it received at the time.

4/18/2023 – SEC Chair Gary Gensler testifies before the House Financial Services Committee, with Republicans accusing Gensler of regulation by enforcement and of pushing crypto business overseas.

4/17/2023 – The SEC charges crypto exchange Bittrex with operating unregistered financial entities.

4/12/2023 – The Small Business Administration finalises a rule that would open up its flagship 7a lending program to fintechs for the first time.

3/27/2023 – The SEC charges Binance, the world’s largest crypto exchange, and its CEO with violating derivatives trading and registration rules.

3/23/2023 – The SEC charges cryptocurrency entrepreneur Justin Sun with a range of violations including running a ring of celebrity endorsements featuring Lindsay Lohan among others.

3/9/2023 – The House Financial Services crypto oversight subcommittee meets for the first time in a hearing entitled “Coincidence or Coordinated? The Administration’s Attack on the Digital Asset Ecosystem”.

3/9/2023 – New York Attorney General Tish James sues crypto exchange KuCoin for operating as an unlicensed broker; notably the suit alleges that Ether is a security, not a commodity, going against the current trend for federal policymakers.

3/1/2023 – The Treasury Department announces the creation of an inter-agency effort to explore the possibility of a digital dollar backed by the U.S. government.

2/17/2023 – Wyoming crypto firm Custodia sues the Fed Reserve after its Kansas branch rejects its application for a Fed master account and access to payment rails.

1/20/2023 – Crypto brokerage Genesis files for bankruptcy as the continued effects of the fall of FTX ripple through the industry.

1/19/2023 – Crypto lending platform Nexo ordered to pay $45m to settle securities law charges by the SEC.

1/18/2023 – The Justice Department file money laundering charges against cryptocurrency exchange Bitzlato and its founder.

1/12/2023 – House Financial Services Chair Patrick McHenry unveils a new crypto oversight committee and names its chair, Rep. French Hill.

1/4/2023 – Coinbase fined $50m by the State of New York for compliance failings.

12/21/2022 – Outgoing Senator Pat Toomey introduces a bill to regulate stablecoins. The proposed legislation would confirm that stablecoins are not securities and are the responsibility of neither the SEC nor the CFTC; instead, the OCC would oversee a licensing process.

12/15/2022 – The New York Department of Financial Services releases customer protection guidance aimed at banks seeking to enter the crypto markets.

12/13/2022 –Senators Warren and Marshall introduce a bipartisan bill that would require crypto firms to comply with anti-terrorism and anti-money laundering regulations.

12/13/2022 – Shortly before his expected testimony before the House Financial Services Committee, FTX founder Sam Bankman-Fried is arrested by Bahamian police. It is expected that he will be extradited to the U.S. to stand charges for fraud.

11/16/2022 – Crypto lending platform BlockFi files for bankruptcy as the collapse of FTX continues to ripple through the industry.

11/16/2022 – Genesis Global Trading, an institutional lender, and Gemini, a crypto trading platform, suspend operations as FTX contagion destabilizes the crypto ecosystem.

11/16/2022 – Senator Kristen Gillibrand announces that she plans to introduce a stablecoin bill before the end of 2022, along with Senators Lummis and Toomey.

11/16/2022 – Fed Vice Chair for Supervision Michael Barr, testifying before the House Financial Services Committee, applauds Congressional efforts to regulate crypto but notes that any cryptocurrency issuers that refer to the USD should be brought under the direct supervision of the Fed.

11/16/2022 – Treasury releases a report noting that while fintechs and other nontraditional lenders make financial services more competitive, they also make it vastly more complicated and are not subject to traditional safeguards.

11/15/2022 – New York Fed launches a digital dollar pilot to examine the feasibility of a shared digital ledger.

11/11/2022 – California regulators suspend BlockFi from operating in the state after it pauses withdrawals in an effort to limit FTX contagion.

11/11/2022 – Cryptocurrency exchange FTX files for bankruptcy in Delaware, wiping billions of dollars of value from FTX, its billionaire founder Sam Bankman-Fried, and broader crypto markets. For more on this development, see The Collapse of FTX.

10/18/2022 –European Commission weighs a potential ban on crypto mining to conserve energy.

10/11/2022 – Treasury fines crypto exchange Bittrex over $53m to settle charges that the exchange violated sanctions and anti-money laundering rules between 2014 and 2018.

10/10/2022 – In advance of a series of meetings of the G20, the Financial Stability Board (FSB) publishes a report “Regulation, Supervision and Oversight of Crypto-Asset Activities and Markets“. The report included nine recommendations relating to supervision, information exchange, governance and disclosures.

10/10/2022 – The Organisation for Economic Cooperation and Development (OECD), an international regulatory standards-setting body, releases measures that would, if adopted, require crypto exchanges to collect and report data on digital asset holders to the relevant tax authorities.

9/16/2022 – FSOC releases a sweeping crypto report, warning that crypto represents a possible systemic risk if not contained by appropriate regulation. The report is curious for its redundancy – it proposes that Congress pass legislation giving agencies regulatory powers over digital marketplaces and over stablecoins. Both measures are already under way. The FSOC also recommends continued enforcement of the existing regulatory structure without demonstrating that existing enforcement is lacking – and further empowering agencies to regulate by enforcement.

9/16/2022 – The Federal Reserve Board of New York release a thoughtful and nuanced review as to the financial stability risks of digital assets, noting that digital market shocks have “limited spillover” into traditional financial markets with limited interconnections.

9/16/2022 – Celebrity Kim Kardashian will pay $1.26m to settle charges from the SEC that she promoted the EthereumMax cryptocurrency (no relation to Ethereum) without disclosing that she was being paid to do so.

9/29/2022 – Senator Toomey, Ranking Member of the United States Senate Committee On Banking, Housing, and Urban Affairs, introduces a bill that would allow 401(k) holders to invest in alternative assets including real estate, private equity, and digital assets. These investments are not currently specifically prohibited, but the lack of clarity is believed to have a “chilling” affect on adoption.

9/26/2022 – Eight states sue cryptocurrency lending company Nexo for illegally offering securities to investors.

9/23/2022 – California governor…

Read More: Tracker: Crypto and Fintech Developments in the Biden Administration – AAF

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.