Enquires@newsofbitcoin.com

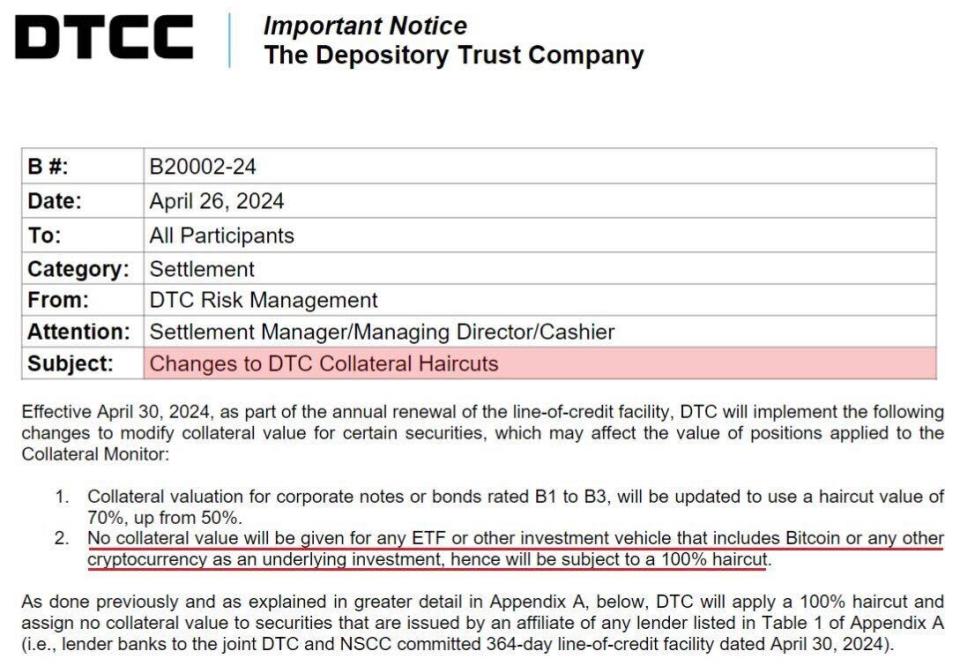

The price of bitcoin BTCUSD fell to a low of $62,801 early Saturday from $63,476 late Friday after the Depository Trust and Clearing Corporation (DTCC) announced it will not allocate any collateral to exchange-traded funds (ETFs) with exposure to bitcoin or cryptocurrencies and will not extend loans against them effective April 30, 2024.

Most Read from MarketWatch

-

After being neutral on Apple’s stock since 2018, here’s why one analyst changed his tune

-

The latest evidence Nvidia’s stock is a ‘no brainer,’ according to this analyst

-

Here are the most efficient companies within the S&P 500’s bargain-stock sector

The DTCC is a financial services company that provides clearing and settlement services for the financial markets.

This decision implies that financial entities utilizing DTCC’s clearing and settlement services will not be able to use cryptocurrency-linked ETFs as collateral when seeking credit or engaging in similar financing activities through DTCC’s system. The change is expected to affect how these ETFs are treated in terms of financial stability and credit assessment, CoinTelegraph reported.

However, in an X post, cryptocurrency analyst K.O. Kryptowaluty clarified that this would only apply to inter-entity settlement within the line of credit system.

A line of credit is a borrowing arrangement between a financial institution and an individual or entity that allows the borrower to draw funds up to a predetermined credit limit.

Despite the DTCC’s new regulations, the broader market and brokerage activities may only see a small impact.

According to K.O. Kryptowaluty, the use of cryptocurrency ETFs as collateral or for lending purposes may continue at the discretion of individual brokerage firms, depending on their risk management strategies and tolerance.

“The use of cryptocurrency ETFs for lending and as collateral in brokerage operations remains unchanged and continues to rely on the risk appetite of individual brokers. Ignore the baseless panic; there’s nothing substantial happening,” K.O. Kryptowaluty wrote on X, formerly Twitter.

The introduction of spot Bitcoin ETFs in the United States this year spurred increasing institutional interest in cryptocurrencies. Within three months of their launch, all U.S.-based Bitcoin ETFs have accumulated over $12.5 billion in assets under management.

However, net inflows to the ETFs have recently slowed down, according to CoinTelegraph. Multiple ETF issuers have reported significant outflows recently.

Most Read from MarketWatch

Read More: Bitcoin falls after DTCC rules out collateral for bitcoin-linked ETFs

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.