Enquires@newsofbitcoin.com

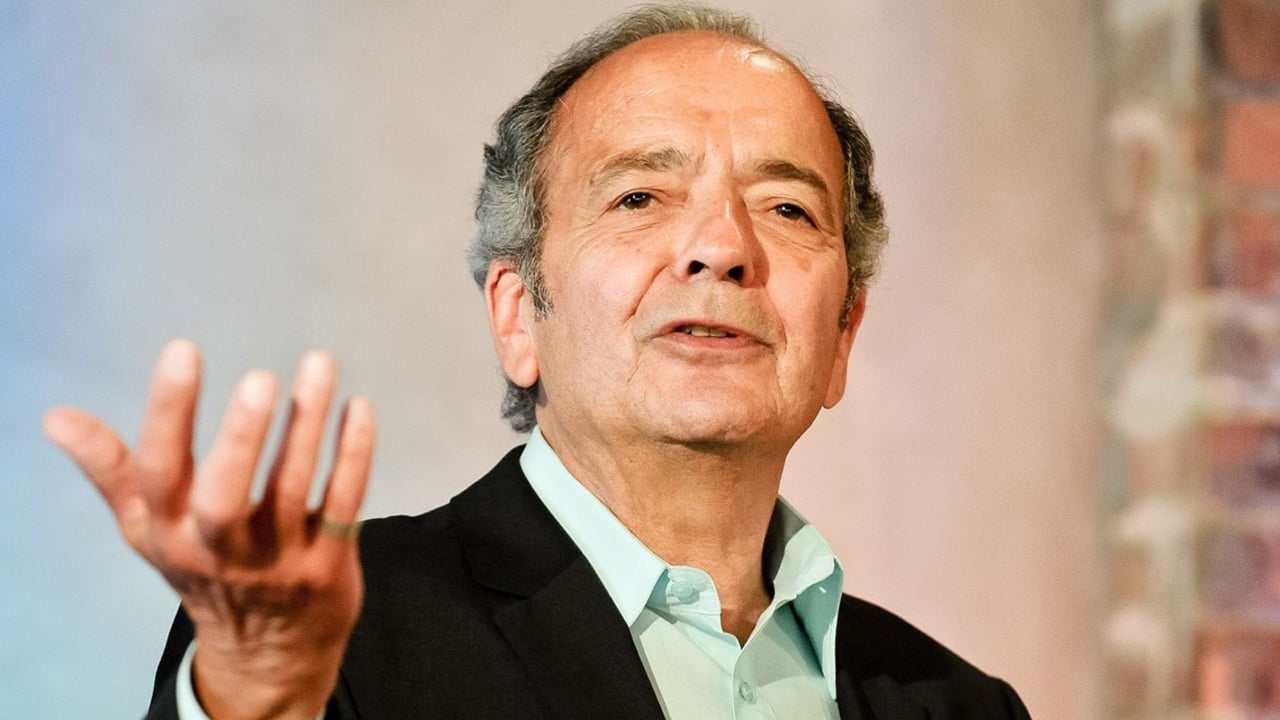

This week Bitcoin.com News spoke with Gerald Celente, the popular trends forecaster, and publisher of the Trends Journal. During a telephone conversation, Celente discussed the uncertainty surrounding the global economy after governments worldwide locked down the world’s citizens over the Covid-19 pandemic, shut down businesses and injected trillions into the economy. The discussion touches upon gold, bitcoin, the pandemic, the Ukraine-Russia war, and the Federal Reserve. The trends forecaster believes that World War III has already begun, and if people do not assemble to bolster peace in this world then we the people are doomed. Celente stressed that if people want real change, they cannot rely on hope as they need to take a stand to make it happen themselves.

Trend Forecaster Gerald Celente Discusses the Economy, Covid 19, Great Reset, Gold, Bitcoin and More

Bitcoin.com News (BCN): What do you think about the global economy and the way it is today?

Gerald Celente (GC): The Trends Journal had forecast this back in 2000. The reality that everybody is forgetting is that the Covid War destroyed the livelihoods of hundreds of millions, if not billions of people. The only thing they did to prevent it was to inject countless trillions of dollars of monetary methadone into the equity markets through their bond-buying schemes and keeping interest rates to negative and zero rate policy.

Then governments pump in countless trillions of free money to keep pumping up the economy artificially. It should have crashed — You got some little jerks telling you: “We’re gonna flatten the curve, we are making up this crap! We’re gonna lock you down. You are a non-essential piece of crap. Meanwhile, the big guys who give me money that morons and imbeciles call campaign contributions” — that adults call “bribes and payoffs” — “they can stay open.”

“We’ll wipe out businesses from coast to coast around the world! Oh, you want to go to a dry cleaner now?” In the United States, a third of them went out of business. Yeah, I wonder why? Because people are not working in the office anymore? Oh, office occupancy rate… Depending on the numbers you see and what crap you swallow — around 50%. You mean all the businesses that used to rely on millions and millions of commuters, can no longer rely on them and they are now out of business… Yeah we’re not going to write about that, as a matter of fact, what we’re gonna do is every time there’s a problem, we’re gonna blame it on the pandemic.

“Oh it’s a result of the pandemic,” they say. “The supply chain issues are a result of the pandemic.”

That’s not a result of the pandemic — it’s a result of you little political pieces of crap that shut down everything and destroyed the livelihoods of hundreds of millions. Oh, and by the way, they sucked the joy out of life and they freaked out the population. Little kids are growing up all screwed up, masked up, vaxxed up, and f***ed up. That’s a big part of it. What people are forgetting is that this thing was going down before the Covid War began.

Just look at the facts. Oh, over there in India, before Covid, what did they have like seven or nine GDP declines in a row? Oh and a place called Germany, the richest economy in Europe… Oh, they were a fraction away from going into an official recession in 2019. You forgot about all the money that they were pumping into the repo markets. What is a repo market? The repo markets are where they give the gamblers on Wall Street and money junkies free money to go gamble. They couldn’t give them enough. They pumped in $7 trillion from September 2019 to January 2020. Did you forget about when the stock market had its worst December in decades back in 2018? Back when Donald Trump forced the central bankster Fed head Jerome Powell to lower interest rates. He did it in January of 2019 and artificially juiced them up — yeah that’s right.

Now they’re raising interest rates and you are watching commodity prices collapsing one after another from corn to cotton — It’s across the board.

BCN: Why is it that U.S. president Joe Biden and Fed chair Jerome Powell are not admitting the country is in a recession? Do you think they ever will admit it?

GC: For the same reason that they wouldn’t admit that there was inflation. They are not going to admit there’s a recession. Look at all the crap they spewed out — They said that inflation was ‘temporary,’ that it was ‘transitory.’ They were making this crap up. They were not that stupid. They knew it was real. They didn’t do it because the economies would have crashed if they pushed up interest rates. It won’t be official until it meets the official characterization of a recession, and that’s two-quarters of negative GDP growth. You had one negative quarter of GDP growth for Germany back then in 2019 and then during the last quarter, it was up 0.1% or something, so you cant officially call it a recession.

When you look at raw material prices from corn to copper to cotton to crude, oil prices are plummeting. The slump in major industrial materials racked up its worst quarter since the panic of 08’.

BCN: What do you think about today’s fiat currencies and the turbulence they face?

GC: The dollar has no real competition. It’s as simple as that. Look at the Chinese yuan. They have a debt to GDP ratio of over 300. Are you going to go to the Japanese yen? In Japan, where they have a debt to GDP ratio of around 260 something. Are you going to go to the euro? When they are still at minus 50 basis points. When inflation in Europe is running hot at 8.6%. Now you have the euro down to its lowest since 2002. So where’s the competition? The dollar is only staying up because there is no competition, and the Fed is raising rates quicker than everyone else.

BCN: Do you think the Russian ruble is as strong as they say it is?

GC: It will be if energy prices stay high. If energy prices go low the ruble goes down with it.

BCN: How long do you think the Ukraine-Russia war will last?

GC: For as long as the United States and NATO (North Atlantic Treaty Organization) support Ukraine. Russia has already won. But it’s a big lie to say that. You know, the Trends Journal wrote about this before the war began. We said that Ukraine should negotiate the issues that Russia is bringing up. Among them was the violation of the Minsk agreement that was put together by France and Britain after the separatist regions of the Donbas region — They were going to be a separatist but not a separate country. It’s been reported that Ukrainians killed an estimated 15,000 of them. The other issue [is] about them not joining NATO. And none of these issues were discussed.

Remember, the Presstitutes in the US reporting on the Russian invasion probably still can’t point to Ukraine on a map

— Gerald Celente (@geraldcelente) July 8, 2022

So we said they should discuss them because they are not going to beat the Russians. Once upon a time, there was a guy by the name of Napoleon Bonaparte… He left Poland with 422,000 troops to attack Moscow. The famous chart. Bonaparte came back with 10,000 troops. Once upon a time, not too long ago, there was a thing called World War II. Adolf Hitler lost Operation Barbarossa which killed an estimated 25 million to 30 million Russians. Who were the first ones to beat the Germans in World War II? The Russians. So now you have the country of Ukraine of 40 million fighting Russia, a country with 140 million and an advanced military. And they are going to beat them? And the United States is going to help them win? When the U.S. hasn’t won a war since World War II. Despite killing millions of people and spending countless trillions of dollars.

So they should have negotiated for peace before it happened so now Russia controls over 20% of the country.

BCN: What are your thoughts on gold right now as a safe haven?

GC: I thought gold would’ve gone much higher. The only reason why gold is going down is because of the robust dollar. Which to me makes absolutely no sense because when economies crash, and this goes back to the panic of ’08, you saw gold spike. Gold is going down now, but it’s getting very close to a breakout point. Again, you have a number of reasons why gold is going down, and one of them, we just mentioned, which is all the global fiat currencies going down. And gold and other commodities are priced in dollars. So now you need more of your currencies that are declining to buy this stuff, and you can’t afford it.

But we see gold, at the Trends Journal, as do I, as the ultimate safe-haven asset. There is no other, it’s been going on since the beginning of recorded history and gold is not going to go away. The other reality is that the markets are rigged. If you don’t believe me. Then go back to 2019, when the bankster gang JPMorgan Chase was fined a measly $900 million dollars for rigging the precious metals markets. This, by the way, is the same Jamie Dimon group that has been convicted of five felonies — JPMorgan Chase. But they don’t go to jail. Like you or I, if we went ten miles over the speed limit and were 0.1% over the alcohol limit, and they had us handcuffed. No, they don’t go to jail. They pay a little fine.

In the new world order, where the ‘Bigs’ own everything, it’s prosecution to the fullest for we the plantation workers of Slavelandia, and little arrogant boys like Jamie Dimon get a slap on the wrist. For committing major felonies. So the markets are rigged. Look at the crap they have like a plunge protection team. ‘Oh the markets are going down too sharply, let’s pump ’em back up! We’re the New York Fed — We got a desk right there on Wall Street.’ That’s all they are, by the way, daddy’s boys and girls, arrogant members of the club — It’s all one big club and you ain’t in it, said the great George Carlin.

BCN: What are your thoughts about bitcoin?

GC: It’s a gambler’s game. The Trends Journal gave the breakout numbers in bitcoin and we were positive on it, to say where the upside is and where the downside is. It’s a new thing, and as long as the big investors stay in it, it won’t collapse. If the big investors pull out — then it’s going to be a rough road. As we were saying back in 2017, in the Trends Journal, we said that the greatest danger to cryptocurrencies is when governments ban them. And then China did it and you saw bitcoin prices plummet when China did that and then it came back.

Number two, at some point in the not-too-distant future, they will do away with dirty cash and go to…

Read More: Trend Forecaster Gerald Celente Says World War 3 Has Begun — ‘If the People Don’t Unite for

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.