Enquires@newsofbitcoin.com

Key Points

-

Cryptocurrency prices look on course to end what has otherwise been a pretty strong week on a sour note.

-

Strong US jobs data has weighed slightly on crypto prices in recent trade.

-

MATIC is the best performer in the top 20 cryptos, while SOL and SAND are notable underperformers.

Market Update

Cryptocurrency prices look on course to end what has otherwise been a pretty strong week on a sour note. Bitcoin was last trading lower by about 1.4% on Friday near $21,300. That means it has fallen back more than 4.5% from earlier session highs around $22,400.

Ethereum, meanwhile, was last trading nearly bang on $1,200, nearly 3.0% lower on the day. The world’s second-largest cryptocurrency by market capitalization has reversed more than 5.5% lower from earlier session highs around $1,280.

Both cryptocurrencies, as well as risk assets such as US equities, dipped on Friday after US labor market data for June came in stronger than expected. The data revealed that the US economy added 372K jobs last month, more than the 268K expected.

The unemployment rate remained unchanged at 3.6% as expected, leaving it roughly in line with pre-pandemic levels. Average Hourly Earnings growth came in at 5.1% YoY, a little higher versus expectations for a drop to 5.0%.

US Labor Market Remains Strong

The data emphasized that the US labor market remains a source of strength in the US economy. The Fed is likely to continue pointing to this strength to justify why it thinks the economy can “handle” aggressive rate hikes.

That explains the modestly negative reaction in speculative risk assets like stocks and crypto. Bulls had been hoping for weak jobs data that might deter the Fed from raising interest rates as aggressively in the coming months.

Still, Friday’s losses aside, it’s been a decent week in crypto. At current levels, Bitcoin is on course to post a weekly gain of over 11%. Ethereum, meanwhile, is set to post weekly gains of around 13%. Most major altcoins are also set for decent weekly gains.

This week’s crypto strength comes despite a powerful rally in the US dollar. The buck has mainly been driven by a rise in expectations for economic deterioration abroad.

The major macro focus next week will be the release of June US Consumer Price Inflation data on Wednesday. Rhetoric from Fed members (notably board of governors member Christopher Waller on Thursday) has suggested the central bank is leaning towards a 75 bps rate hike later this month. Crypto bulls will be hoping for a downside inflation surprise that might give the Fed room to hike by less.

Here is a list of the top three trending coins of the day on Friday.

Polygon (MATIC)

The native token of the Polygon blockchain MATIC is the best performer in the top 20 cryptocurrencies by market cap over the past 24 hours with gains of more than 5.0%. On the day, despite the broad decline seen across most other cryptocurrencies, MATIC is still around 3.0% higher.

MATIC/USD was last changing hands just under $0.58, having come within a whisker of $0.60 earlier. The cryptocurrency is currently probing a downtrend that has been capping the price action going all the way back to mid-May. A break above $0.60 could provide MATIC with the technical impetus it needs to push higher towards $0.70.

News on Thursday that popular social networking website Reddit launched its “collectible avatar” marketplace on the Polygon network may have been supporting the cryptocurrency over the past few days, analysts noted.

Solana (SOL)

The native token on the Solana blockchain SOL has seen choppy trade thus far this Friday. According to CoinMarketCap, it is one of the worst-performing cryptocurrencies in the top 20 by market cap over the last 24 hours, having clocked a loss of about 2.0%.

SOL/USD momentarily broke above its 50-Day Moving Average (at $38.70) earlier in the session and touched $40 per token. The pair has since reversed sharply lower to trade just below $38. But the pair found support at its 21DMA just above $36.

Friday’s indecisive price action means that SOL/USD is still consolidating within a pennant that has been in play since early June. A downside break (perhaps triggering a move under $35) would signal a potential drop all the way back to annual lows near $25. An upside break could open the door to a rally towards the key $47.50 support turned resistance area.

The Sandbox

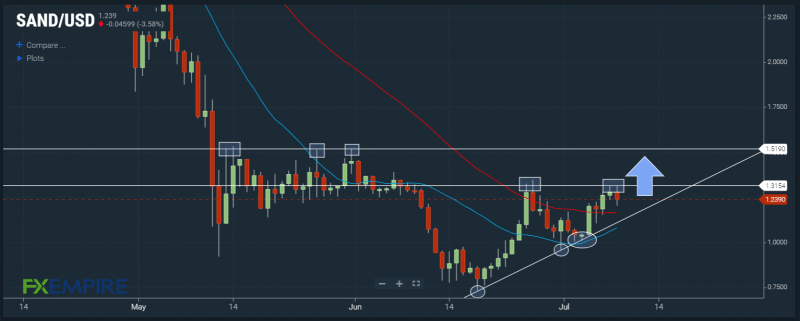

The native token on the decentralized metaverse platform The Sandbox SAND is the worst-performing cryptocurrency in the top 50 by market cap over the past 24 hours, CoinMarketCap data shows. SAND was last trading with losses of over 4.0% versus 24 hours ago, having reversed sharply lower from an attempt to break above $1.30 earlier this week.

SAND/USD was last changing hands around $1.2350, with the pair having fallen short of a test of its late-June highs around $1.35. Still, SAND’s technicals are looking ok. The cryptocurrency has been supported by an uptrend since mid-June.

The pair seems to be forming an ascending triangle with the $1.30 area as its ceiling. This technical pattern typically proceeds a bullish breakout. A break above the $1.30 resistance area would open the door to a run higher towards late-May highs just above $1.50.

This article was originally posted on FX Empire

More From FXEMPIRE:

Read More: Top 3 Trending Coins: MATIC Eyes Bullish Break of Key Downtrend, SOL & SAND Underperform

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.