Enquires@newsofbitcoin.com

Gigi is a Bitcoin educator, author of ‘21 Lessons‘, and software engineer.

__________

It can’t be said often enough: Bitcoin is confusing. However, it’s not complicated like a Rube Goldberg machine is complicated. It’s just very foreign and thus very misunderstood—it is a completely new thing. “There’s nothing to relate it to,” as Satoshi [Nakamoto] put it in one of his posts.

Because there is nothing to relate it to, we are all having a hard time wrapping our heads around the various aspects of it. We need to use words if we want to talk about it in a meaningful way, and words are what I will focus on.

I want to talk about two things: (1) the language used in Bitcoin and (2) the language used to attack bitcoin.

Part 1: The Language Used In Bitcoin

Let’s get one thing out of the way: it’s all numbers, all the way down. Bitcoin does the one thing that all computers do, which is actually two things: it takes certain numbers as inputs, does calculations, and presents the result of said calculations to someone else. In Bitcoin’s case, this “someone else” is another node on the network—or multiple, to be precise. When stripped down to its bare essentials, that’s all there is to it: math and messages.

Consequently, we have to use metaphors—and lots of them. Keys, wallets, addresses, signatures, contracts, mining, dust, fork, oracle, orphan, seed, witness—the list goes on.

However, here’s the thing with metaphors: “All metaphors are wrong, but some are useful,” to paraphrase George Box.

Undoubtedly, many people are confused precisely because of the shortcomings of these metaphors. All the labels that we apply to the various concepts in Bitcoin are wrong, at least a little bit. Some are wrong a lot. Everyone who ever tried to explain that “your bitcoins are not actually in your bitcoin wallet” to a glossy-eyed newbie knows what kind of confusion I’m talking about.

Unfortunately, this confusion won’t be going away anytime soon. And more worryingly, this confusion is being weaponized by legislators, politicians, and commentators alike.

Those who despise Bitcoin are trying to pass laws and plant ideas in people’s heads that are bastardizing how Bitcoin works, as well as the language we use to describe how it works. Consequently, it would be beneficial to get our language straight. After all, how high are the chances of understanding something deeply if the words we use to describe said thing are inadequate?

First, let’s go through some of the words we use in Bitcoin and see where they fall short. We all know these words, and we usually don’t think twice about them. Let’s start with “wallet.”

“Wallet”

A wallet is a piece of software or hardware that makes it easier or more secure to store and/or spend your bitcoin. It’s easy to see that a wallet is neither one thing nor easily defined; just look at all the various forms of wallets we came up with over the years: paper wallet, brain wallet, hardware wallet, mobile wallet, multisig wallet, lightning wallet, watch-only wallet, and so on.

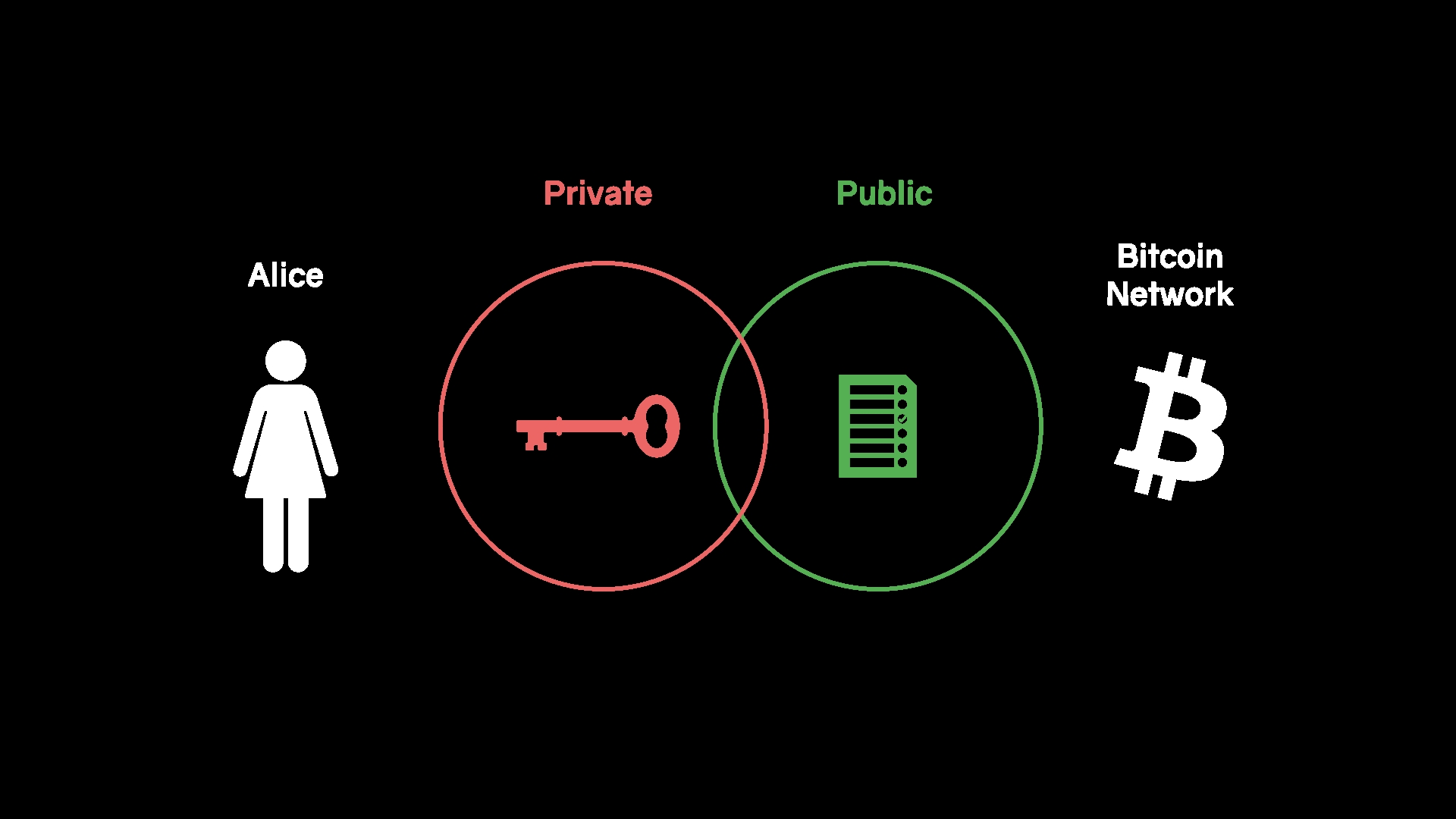

In the end, we have to understand how Bitcoin operates if we want to get a grip on what a wallet is. Here is the gist of it: to create a bitcoin transaction, you need to sign a message with a private key. Consequently, two things are essential for a wallet: key storage and signing. But that’s not enough, usually. To interact with the Bitcoin network, you need to interact with a Bitcoin node. You need a way to access the public information, the “distributed ledger” that is so often mentioned by finance and crypto bros alike.

What we have historically called a bitcoin wallet, thus, is just some software that manages and stores keys and allows the user to easily use these keys to sign and broadcast messages. To increase security, said software might be embedded in a dedicated hardware device. The more effort it is to spend your sats, the lower the risk of theft or loss of funds. A wallet might not have any signing capability at all, as is the case for brain, paper, or watch-only wallets.

This begs the question: how useful is the term wallet?

Interestingly, we have already switched to a different term when it comes to seed storage. We are not talking about “metal wallets” or “metal keys” when we talk about key storage; we usually talk about seed storage, metal seeds, or seed plates nowadays.

Further, we now refer to various multi-signature and timelock constructs as “vaults”—a powerful and clear distinction. The vault metaphor makes it immediately obvious that whatever is stored in the vault is there for the long haul. It isn’t spendable easily or quickly.

I hope that, in the future, we will also manage to do away with the generic “wallet” term. When it comes to hardware wallets, a change of terms is already underway. Given that a hardware wallet is nothing but a small device that is used for signing transactions, a more accurate term is “signing device,” which is currently gaining traction thanks to people who understand the technicalities of Bitcoin deeply.

Maybe usage will morph so that whenever someone says “wallet,” it is implied that it is something that isn’t holding massive amounts of value and that said value is spent easily and quickly, as is the case for Lightning wallets.

In the end, the “wallet” metaphor will always be wrong in a crucial way: your wallet does not actually hold any of your coins. That’s not how Bitcoin works.

It might hold your keys, which brings us to the next word.

“Key”

In the physical world, a key is used to open something. A door, a chest, a locker, and so on. It might also be used to start something: a car, a motorbike, a nuclear missile—you get the idea.

As mentioned before, to create a bitcoin transaction, you use your private key to sign a message. The keys in bitcoin are cryptographic keys, and cryptographic keys can be used to create digital signatures.

This, of course, only makes sense in the world of cryptography. Commonly, a key is used to lock and unlock things. If you want to sign something, you need a pen. This confusing metaphor is not exclusive to Bitcoin, of course. Plenty of other software uses cryptographic keys to sign stuff, which is why in 2010, this abomination of an emoji was introduced: the padlock, “locked with pen.”

Consequently, a “key” in bitcoin is more like a pen, not an actual key. Granted, you can use your key to “unlock” sats that are “locked” by yourself or someone else, but still, no matter what metaphor you use, it will always fall short.

It will always fall short because the keys in Bitcoin are data, nothing else. Your private keys are secret information—information that nobody but you should ever know. If someone else gets possession of your private keys, your bitcoin will be their bitcoin.

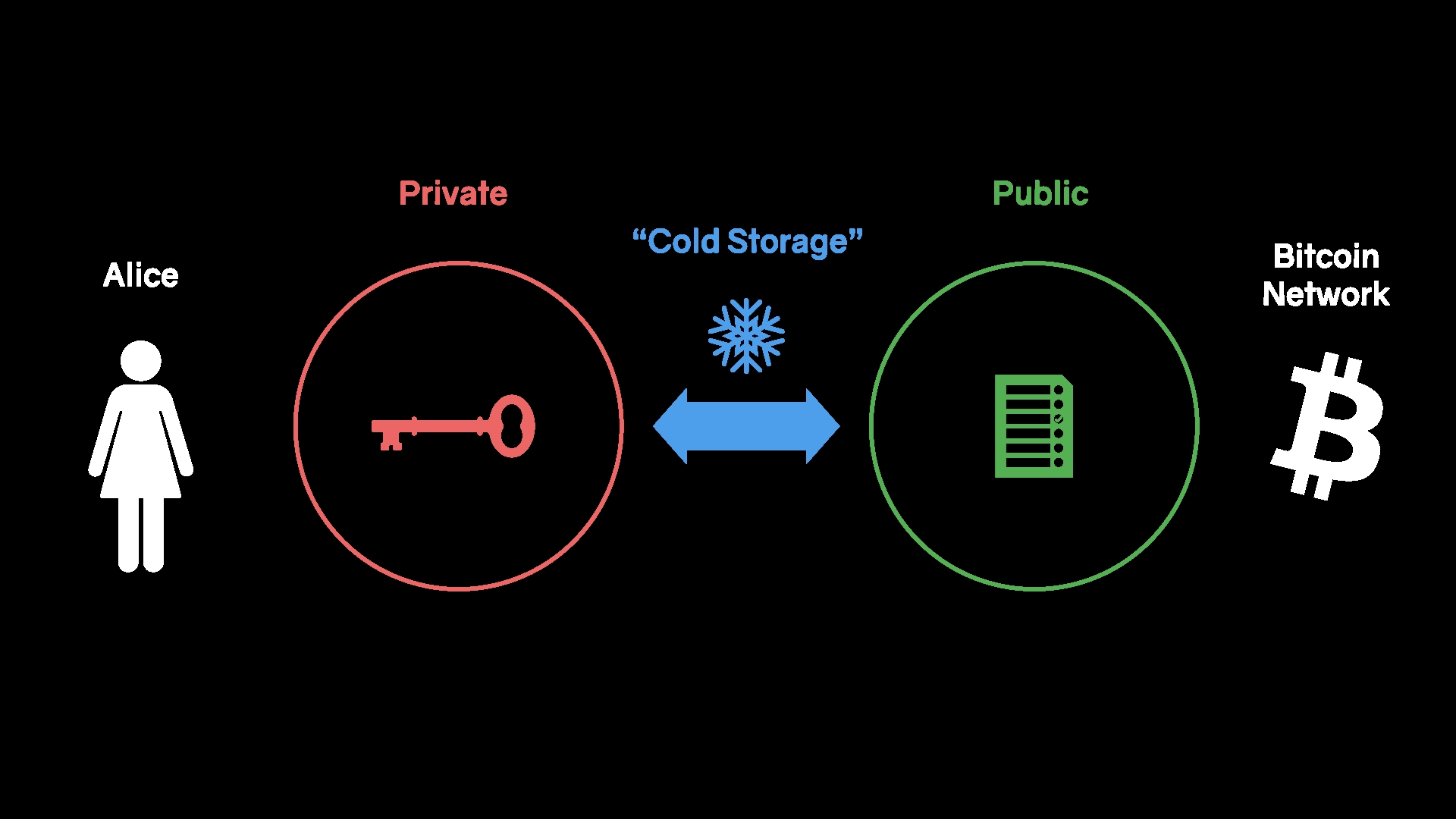

To make theft or accidental spending as difficult as possible, keys that give access to large funds are held in “cold” storage. The secret information is disconnected from the internet, held on special signing devices that never touch a general computation device.

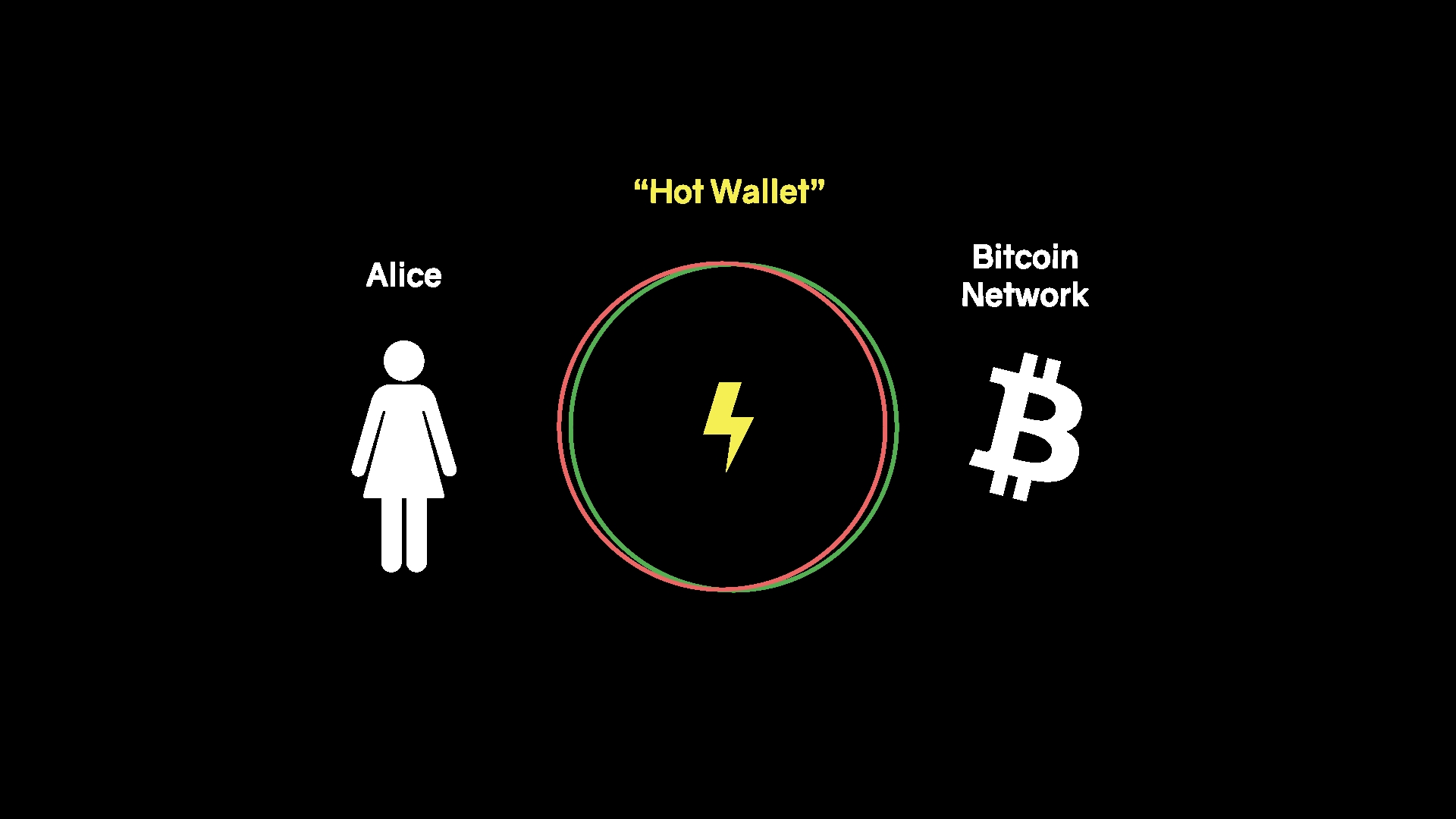

A “hot wallet,” on the other hand, brings the secret information required to move your sats as close to the network as possible. If you want to spend frequently, your keys have to be readily available. A lightning wallet, for example, is a “hot” wallet: the private keys that allow you to spend your sats are connected to the internet at all times. If your computer or smartphone is compromised, your funds are at risk. Such are the tradeoffs between “hot” wallets and “cold” storage.

“Hot” and “cold” are again, of course, metaphors. A hot wallet is hot like a microphone in a recording studio is hot. It means that it’s charged, fired up, and to be handled with care, not that its temperature actually increased.

We can see that language is neither singular nor static, which makes the line between a useful metaphor and an outright linguistic attack a blurry one.

The “key” metaphor, for example, isn’t terribly wrong. We can actually think of signing as unlocking. The underlying elements responsible for spending sats are referred to as locking and unlocking scripts, and for good reason. These scripts are small computer programs that define the conditions that are required for certain sets of sats to move. You can think of it like this: those who want to move sats have to solve a cryptographic puzzle. Usually, a private key is required to fulfill the spending condition: the key is the key to the puzzle. So if we think “key to the puzzle,” it’s not even wrong. And anyway, I’m afraid we’re stuck with it.

Two more things: the reason why your private key can be represented as words is that it is, just like everything else in bitcoin, information. And the reason why we call these words a “seed phrase” is because your private key is the seed from which all your other keys and, ultimately, addresses are derived from. This brings us to the next word: “address.”

“Address”

This is probably the worst of all. To quote Luke Dashjr: “It’s so bad, we made a BIP to get rid of it.” He is talking about BIP 179, a Bitcoin improvement proposal that’s sole purpose is to propose a new term for “address.” The new term is “invoice,” which is the default in lightning and is actually more accurate—technically speaking—even on the base layer.

It is more accurate because bitcoin transactions do not have a “from address,” even though you might think they do, especially if your mind is poisoned with the “address” metaphor.

The concept of a “from address” only exists heuristically. In Bitcoin, only receiving addresses exist. A transaction does not contain a from address. A transaction only contains the aforementioned scripts, which are challenges and solutions to challenges. If you can solve the challenge, you can move the coins.

The way to think about this properly is to think about flows, not coins.

Let’s say you take a big scoop of water out of a lake, and let’s further say that this lake is fed by multiple streams. It’s a pristine lake in a mountainous region, so you fill up your bottle to cool yourself off with a refreshing drink. You sit down, take a sip, and ponder the following question: where did the water in your bottle come from?

From the lake, obviously—but from which stream? And how many molecules came from the clouds directly, raining down on the lake? Can you tell, even in principle? A God-like entity probably could, since water consists of molecules, and you could—at least in theory—track said molecules.

You can understand Bitcoin and bitcoin transactions in a similar way: transactions can have multiple inputs and multiple outputs, i.e., inflows and outflows, to stick with the liquid metaphor. However,…

Read More: The Words We Use In Bitcoin: Words, Language, Terminology, and Linguistic Attacks

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.