Enquires@newsofbitcoin.com

Solana (SOL) and Avalanche (AVAX) were top performers in 2021 and 2023, offering a more scalable solution to Ethereum (ETH). Both ecosystems grew from a few million to billions of dollars in capitalization, rewarding crypto investors who embraced the opportunity.

Now, as technology evolves, new investment opportunities surge in the cryptocurrency landscape through yet low-capitalized improved technologies.

In particular, Radix (XRD) appears as a promising contender among layer-1 cryptocurrencies looking at decentralized finance (DeFi) and Web3 solutions. Radix is part of a group of chains using sharding to scale their capacity while preserving decentralization and security.

Other ‘sharded’ chains are MultiversX (EGLD), Near (NEAR), Sui Network (SUI), and Toncoin (TON), to mention a few. Notably, XRD currently has the lowest capitalization among these competitors, with less than $1 billion in market cap.

Radix (XRD) fundamental analysis

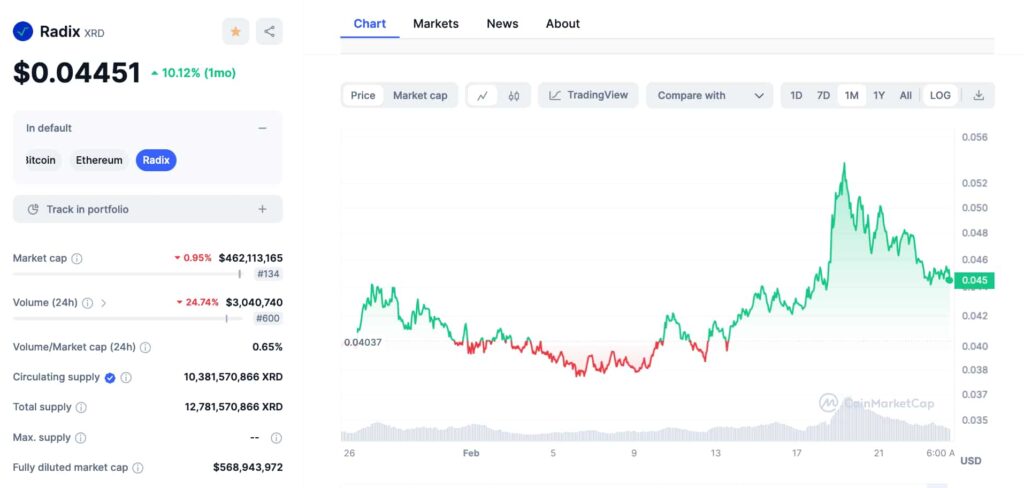

From a fundamental analysis perspective, Radix is a $462 million cryptocurrency, trading at $0.044. The DeFi-focused project has 10.38 billion XRD circulating out of the 12.78 billion total supply. This makes XRD a low-inflation token, at around 2.5% yearly, issued through the proof-of-stake mechanism with native delegation.

In the past, we have seen memecoins like PEPE surpassing the $1 billion market cap zone in a few days. Probably positioning Radix at a discount considering its problem-solving abilities with less than half of this value.

On that note, Radix thrives as one of the most innovative technological stacks in DeFi. Its asset-oriented model prevents wallet-draining hacks, common in projects similar to or compatible with the Ethereum Virtual Machine (EVM).

Moreover, Radix’s development language, Scrypto, and its consensus algorithm, Cerberus, guarantee easy onboarding for developers, plus atomic-composability for the sharded transactions the network processes.

Radix (XRD) technical analysis

Meanwhile, the weekly chart suggests XRD as an interesting crypto investment opportunity for traders who missed SOL, AVAX, and others.

This is due to a recent breakout from a yearly downtrend, coinciding with a breakout from the 20-week exponential moving average (EMA). Interestingly, Radix went from $0.05 to above $0.15 per token the last time it happened.

A price action mirroring this previous activity would put XRD at $0.1 per token for a nearly 125% gain. Additionally, this would make Radix overcome the $1 billion capitalization mark. Still, l less than 10 times what Solana and Avalanche have while solving relevant issues from both networks.

It is worth mentioning both SOL and AVAX went through major network outages in 2024.

In conclusion, Radix may be a promising crypto opportunity for investors interested in DeFi. It has a growing ecosystem with decentralized exchanges, lending protocols, betting, and even a popular memecoin called HUG.

Nevertheless, XRD is a low-cap and low-liquidity cryptocurrency, which exposes investors to risks. Therefore, caution is crucial when investing and speculating in these experimental projects.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read More: New crypto opportunity at $0.04 for investors who missed SOL and AVAX price rally

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.