Enquires@newsofbitcoin.com

(Kitco News) – The crypto market was in recovery mode on Thursday as Bitcoin (BTC) spiked back above $69,000 after spending the past three days treading water around support at $66,000.

The rally higher for BTC comes as inflows into spot BTC ETFs have started to trend up following five consecutive days of outflows from March 18-22 that saw nearly $891 billion worth of funds exit the products.

Stocks opened higher and traded in the green for most of the day, but fell under pressure late in the afternoon after Minnesota Fed President Neel Kashkari suggested the Fed may not cut interest rates at all this year if inflation remains elevated.

Investors now look to Friday’s update on the March jobs report to get a better read on what comes next from the Fed as the report is seen as a key piece of economic input for the central bank’s data-dependent policy.

At the closing bell, the S&P 500, Dow, and Nasdaq all finished lower, down 1.23%, 1.35%, and 1.40%, respectively. Following yesterday’s spike to 4.43%, the yield on the U.S. 10-year Treasury note fell 2.77% on Thursday and sits at 4.305% at the time of writing. Gold is also trending lower after tapping a new record high of $2,305.63 earlier in the trading session, currently down 0.9% from the high and trading at $2,285.

Rising Bitcoin volatility

Data provided by TradingView shows that Bitcoin started the day with a dip to $65,070, but has since reversed course and rallied to a high of $69,370, a turnaround of 6.62%. At the time of writing, BTC trades at $67,820, an increase of 3.1% on the 24-hour chart.

BTC/USD Chart by TradingView

While traders were happy to see Bitcoin’s price rising on Thursday, market analyst Bloodgood warned his readers to be careful of another potential “fakeout for Bitcoin on the horizon.”

“Bulls were disappointed after a bullish end to the previous week. BTC dropped almost 10% in the first two days of this week, but more importantly, a higher low was printed on the daily timeframe,” he said. “However, there was also a lower high printed which suggests that a symmetrical triangle has formed, so that a break of either of these two trendlines will show us where we’re going, although it’s a good idea to wait for this weekly candle to close before jumping to any conclusions.”

“The Bitcoin halving is in roughly 16 days, so a lot of volatility is expected, and technical levels might not matter here,” Bloodgood noted. “We discussed last week that the $68k level is a must-hold for continuation, so I expect bulls to fight for it.”

“As we all know, dips can be incredible opportunities to get the good entries that you’ve been waiting for, but only if you’re not too scared to execute, which is why now is a good time to think about the importance of conviction,” Bloodgood said.

“An excellent example of that mindset is the recent annual investor letter by Multicoin Capital, where the firm revealed that their crypto hedge fund has returned over 9,000% since its inception in 2017, while the return for 2023 alone was over 500%,” he noted. “That sounds great, of course, but we can only really appreciate what it means when we consider their drawdown in 2022, which was 91.4%.”

“Few things better encapsulate the reality of crypto than those few simple PnL figures. How many people would have what it takes to survive a 90%+ drawdown? Not many, but those that can are also the only ones that can make close to 100x in a couple of cycles,” Bloodgood concluded.

Rising interest in Bitcoin

Despite the lull in Bitcoin price and ETF inflows over the past two weeks, “Interest in Bitcoin is continuously growing – from institutions and asset managers entering the space to countries putting Bitcoin on their balance sheets,” said Zach Bruch, founder and CEO of MyPrize, in a note to Kitco Crypto. “There is more demand for Bitcoin today than ever before.”

And the demand pressure is set to increase in a couple of weeks after the halving takes place, he noted.

“When you think about what could happen with the upcoming halving, it comes down to mostly supply and demand,” he said. “The mining reward is being cut in half. With lower rewards, there is less Bitcoin supply coming every day and less sell pressure from miners.”

“Less sell pressure combined with the increased demand from institutions and others entering the space means that we’re more likely to see a price increase like we have after every halving historically,” Bruch said. “The current market dynamics signal that we are looking at a very unique setup for what’s to come.”

“Beyond the Bitcoin price, I think we could see Bitcoin miner stocks increase as well during this cycle,” he added. “Those prices have remained relatively consistent since Bitcoin was around 50% of the current price level and the market dynamics today could allow for that to change.”

Altcoins back on the uptrend

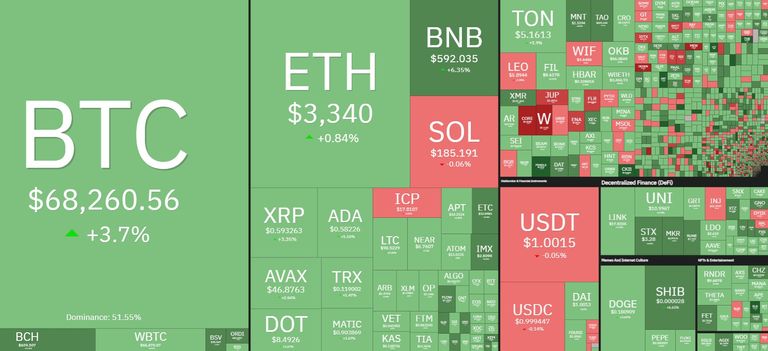

It was an overall positive day for altcoins as the large majority of tokens in the top 200 recorded gains, with roughly 24 projects seeing losses.

Daily cryptocurrency market performance. Source: Coin360

Aragon (ANT) led the field with an increase of 43.2%, followed by a 37.6% increase for Pendle (PENDLE), and a 15.4% gain for Nervos Network (CKB). The newer meme coin ‘cat in a dogs world’ (MEW) fell by 19.7% to lead the losers, followed by a loss of 18.9% for Wormhole (W), and a decline of 17% for Core (CORE).

The overall cryptocurrency market cap now stands at $2.57 trillion, and Bitcoin’s dominance rate is 52.6%.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Read More: Bitcoin spikes above $69k while stocks, gold, and Treasury yields trend lower

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. NewsOfBitcoin.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.